Connecting impact investing to the capital markets

through financial engineering expertise

Eighteen East Capital (Eighteen East) was born in 2014 out of the desire of its founders Thomas Venon and Dave Portmann to contribute to the growth of impact investing by applying their financial markets expertise, and their understanding of the challenges facing African development. They were joined in 2015 by Emmett Pearce who brought with him a successful track record in asset management, and established Eighteen East’s presence in London. Collectively they believed that a technically robust approach to the creation of market solutions could deliver real and lasting change.

The first initiative in this regard was Impact Investment Trust PLC and they have since sought to grow Eighteen East through the identification of opportunities to develop the impact investing market infrastructure, and through key partnerships with aligned institutions.

In 2018 David Escoffier joined the company as a partner after a long and prominent career in financial services. Born in Kinshasa and having spent part of his youth in Africa, he was looking to channel his energy through a vehicle dedicated to accelerating the continent’s development. He discovered impact investing as a concept, and Eighteen East as a business, to be the ideal outlet for his interests and expertise in global markets, and has proven a highly complementary addition to the team.

)

Dave was born and raised in Cape Town, South Africa, and gained extensive experience across Africa during his three years as a senior consultant at Douglas Parker Associates, where he led the Shoprite Group’s property research. He also spent four years in general management heading up USABCO’s hardware division. Dave holds B.Sc. (Hons) in Environmental Science and Economics and MBA degrees from the University of Cape Town, and his article on private equity in South Africa was published in the South African Journal of Economic and Management Sciences.

)

Hailing from Normandie, France, Thomas has 20 years experience in the asset management industry. Recently head of institutional business at African Alliance, he previously was a director at S&P Fund Research, and held senior positions at RBS/ABN Amro and Old Mutual. He holds an MBA from the University of Cape Town and a Master’s in Applied Finance from the University of Melbourne. Thomas was listed amongst MENA Fund Manager Power 50 individuals in 2012, and founded the Africa Impact Report in 2011.

)

A French national, born in Kinshasa, DRC, David started his banking career in the early 90’s, initially with Credit Lyonnais, then for SG Cowen in New York and Société Générale in London, where he held senior management positions as Global Head of Equities & Derivatives, Global CEO of Newedge, Global Head of Sales, and most recently Deputy Head of Global Markets. David has held directorships with global trade associations including the GFMA and FIA, and served on several corporate boards, including Lyxor Asset Management. Throughout his career he has been a passionate supporter of charitable work, notably as a trustee of the SG UK Group Charitable Trust. David is a graduate of Sciences-Po Lyon.

)

A UK national, Emmett has been active in financial markets for 28 years. Having worked for 8 years in corporate debt at Citibank and UBS, he spent the subsequent 16 years in alternative asset management, first with Klesch & Co and then in director-level positions at Liberty-Ermitage and RBS/ABN Amro, where at the latter he was the Extel No. 1 rated hedge fund salesperson in 2010 and No. 2 from 2007 to 2009. Most recently he ran his own alternative asset advisory company. Emmett holds a business degree from Cardiff University and an MBA from Manchester Business School.

Eighteen East seeks to put its partners’ expertise and capital markets experience towards connecting impact investing with the financial markets to unlock additional pools of capital and improve living standards across developing countries.

As a growing and diverse universe of investors seek to do more than maximise financial returns, new and innovative market solutions must be built. This is what Eighteen East refers to as Impact Engineering, and it is through this process that new sources of capital can be unlocked to improve living standards through development.

Leveraging off its partners’ long careers in financial markets, consulting, and industry, and with a clear focus on developing countries in general, and Africa in particular, Eighteen East seeks to create and design appropriate financial structures for the impact investing sector. These strive to improve liquidity, increase capital velocity, and take advantage of the protection afforded by the most robust regulatory frameworks to improve accessibility, and allow all categories of investors to make a difference.

Principles

Eighteen East is committed to the principles of independence and transparency, and strives to incorporate the strongest levels of governance in all initiatives and engagements. Eighteen East partners are based in London and Cape Town and share a common energy for the improvement of lives in developing countries through the harnessing of the capital markets for impact.

Eighteen East is a supporter of the UN Principles for Responsible Investment.

Eighteen East works with the following types of institutions:

Corporates / Development Finance Institutions / Development Agencies / Exchanges / Family Offices / Foundations, Charities, and NGOs / Index Providers / Investment Banks / Institutional Investors / Private Banks and Wealth Managers

Development Finance Institutions

Development Finance Institutions (DFIs) are the longest-serving and arguably most important players in the allocation of development and impact capital to developing countries. Created and funded by governments and multilateral agencies to invest for development in countries and sectors that would otherwise struggle to attract capital, DFIs have grown in size and relevance and now manage over USD300 billion. DFIs boast the longest track records in impact investing and have the most extensive networks, resources, and investment pipelines in developing countries.

Eighteen East believes that private and institutional investors should increasingly leverage the expertise built by the DFIs through innovative impact products and strategies. Eighteen East’s partnership with Obviam on the Impact PLC project is a good example of one such initiative. Through the provision of Impact Engineering, Advisory, and Research services Eighteen East aims to continue to work with DFIs to unlock increasing amounts of new capital for impact and development.

Impact Engineering | ɪmpækt ˌɛnʤɪˈnɪərɪŋ |

The process of designing and building the necessary structures to integrate impact investing into global markets, and to catalyse the flow of capital seeking to improve living standards through sustainable development.

Impact Engineering is the creation and adaptation of financial solutions designed to support the growth of the impact sector. Leveraging the deep experience and technical expertise of its partners, Eighteen East specialises in the development of appropriate market structures that integrate impact investing into the global capital markets, and unlock the sector’s ability to improve living standards at scale.

This is strengthened by the formation of partnerships with key stakeholders including DFIs, development agencies, foundations, and financial services institutions.

Recent examples of such initiatives include:

-

The conception and structuring of Impact PLC, a ground-breaking listed impact investing vehicle.

-

The development of ImpactBay, a secondary marketplace for impact fund investments in emerging markets.

Impact Investment Trust PLC (Impact PLC) harnesses the liquidity, governance, and accessibility of the world’s most established stock exchanges to increase access to impact investing through the creation of a familiar, robust, high-quality impact investment product for private banks and wealth managers.

By adapting the time-tested, London Stock Exchange listed closed-end investment company (CEIC) structure, and enlisting the expertise and track record of Obviam, the long-time manager of the Swiss DFI, Impact PLC makes investing for impact in developing countries available to all categories of investors in a liquid, low minimum investment, highly regulated format.

Impact PLC is a precursor to what Eighteen East expects will become a growing universe of stock exchange listed impact investing vehicles, and a new market for allowing all types of investors to deploy capital with the dual intention of generating financial returns and assisting in the development of economies and communities that are most in need.

Eighteen East published a toolkit in 2017 explaining how to set up a CEIC, with the intention of sharing the knowledge generated by the Impact PLC initiative.

*Initial structuring and test marketing costs were funded by UK aid from the UK government (under the DFID Impact Programme)

Funded by the Rockefeller Foundation, ImpactBay is designed to create a secondary market for existing impact investments, and by allowing investors to recycle their capital it will have a multiplier effect on the aggregate capital deployed.

Impact investing has traditionally focused on private equity and private debt instruments that are typically not traded, and provide investors with little or no opportunity to exit before the end of their full investment term. This in turn means that the Foundations, DFIs, and private investors that provide the cornerstone capital are tied in for very long periods of time, and cannot redeploy this capital into new vehicles until these investments have come to maturity. As this pool of catalytic capital is finite, its immobilization is a serious stumbling block for the growth of impact investing.

On the other side of the equation, mainstream investors are naturally reluctant to try a new investment approach when it is associated with a very long-term commitment. In addition, LP type impact investments are typically associated with both a J-curve effect and a blind pool nature, making a first foray into impact a daunting prospect.

By partnering with Euronext Expert Market, and through the simplification and the facilitation of secondary transactions in existing impact investing funds, ImpactBay has the potential to have a multiplier effect on the aggregate amount of capital available for impact investment, by allowing catalytic investors to recycle their capital before the end of the LP lifecycle and by presenting traditional institutional investors with access to mature impact investments with an enhanced risk return profile and a shorter duration

Using a rigorous multi-step engagement process, Eighteen East advises asset managers, DFIs, development agencies, corporates, and NGOs on a range of challenges, from impact market positioning through to innovative product development, assessment, testing, and capital raising. Eighteen East partners are able to call on deep public, private, and philanthropic networks, and extensive sales experience in both traditional financial markets and impact investing to bring a clear and targeted solution to impact investors seeking to raise new capital.

Recent advisory engagements include:

-

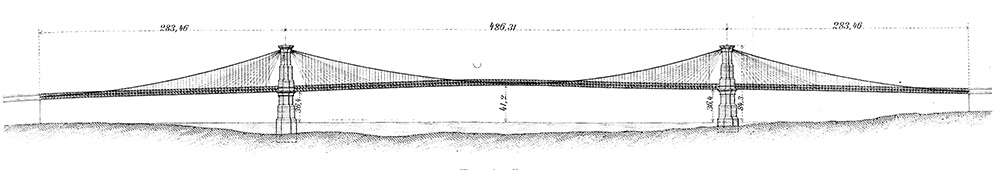

Emerging Africa Infrastructure Fund (EAIF): Eighteen East developed a CIS blue print and conducted an investor outreach exercise to establish the demand for new private investment in the provision of infrastructure debt in sub-Saharan Africa. This required extensive engagement with stakeholders including Investec Asset Management and the Private Infrastructure Development Group, and a final submission to the EAIF board.

-

Shell Foundation: Eighteen East assisted with the creation of a facility designed to deliver impact at scale for low-income households and businesses in Africa, and to crowd in private capital towards the achievement of SDG 7 (access to affordable, reliable, sustainable and modern energy for all).

With the world of tomorrow in mind, Research services form an integral part of Eighteen East’s offering and serve to underpin all Impact Engineering initiatives and Advisory engagements.

It is part of the mission of Eighteen East to help build the necessary market structures to unlock the full potential of impact investing. To this end, and with a view to sharing information with all the stakeholders, Eighteen East seeks to take an open-source approach whenever possible to the creation and publication of Research materials.

Examples of Eighteen East’s publicly available Research publications can be found here.

Eighteen East undertakes research across two broad categories:

-

Impact Engineering Research into potential market building solutions and structures. This work is designed to inform the development of new products, platforms, and strategies, and is made available through the publication of white papers.

-

Bespoke Research linked to Advisory engagements on behalf of institutions and businesses looking to better understand how to unlock the opportunities presented by the increasing interest in impact investing and sustainable development.

GIIN: Annual Impact Investor Survey 2018

Rockefeller Foundation: Foreign Affairs Journal

GIIN: Roadmap for the Future of Impact Investing

J.P. Morgan: Impact Investments – An Emerging Asset Class

Bertha Centre: Impact Barometer 2018

GIIN and Cambridge Associates: Introducing the Impact Investing Benchmark

World Economic Forum: Impact Investing – From Ideas to Practice

US National Advisory Board: Private Capital, Public Good

UBS: Impact Investing – Doing well by doing good